An Open Banking Journey

A transformation in

financial services is accelerating worldwide, promising to deliver an unprecedented spectrum of services – inspired by customer lifestyles, available on demand, anytime, anywhere. It’s called Open Banking and it challenges everything banks do for customers today. Fintech, Big Tech, data aggregators, digital banks and even non-banks are racing to collect, integrate and analyze data to create innovative financial services. In an Open Banking world, where customers decide who accesses and uses their data and can receive services from non-banking entities, the critical question is how will banks remain relevant?

Customers are not always loyal to a brand but rather to the overall value provided in a service. Customers refinance mortgages when offered a lower rate with another lender. They go with the credit card offering the most loyalty points or best zero interest balance transfer. This has been the one-dimensional game played to win customers to date.

This game now fast-forwards to a battlefield where winning customers is increasingly done by delivering personalized services that compete on a value proposition with a blend of features including accessibility, convenience and price. It’s clear that banks choosing a do-nothing strategy leave a door open for Third Party Providers (TPPS) to disintermediate the relationship they’ve enjoyed with customers

(1).

Open Banking demands that CEOs, as well as their executive leadership team for product, digital and data, make the leap to a customer-driven business model. This means that chief product officers must adopt service design cycles that truly understand and uncover customer financial needs – everything from paying a babysitter to financing a small business. Chief digital officers must strive to leverage technology and channels to anticipate and fulfill customer needs. Chief data officers and CEOs must therefore elevate the importance of data and analytics as an enterprise strategic asset to operationalize Open Banking.

Co-opetition best describes the business models under which banks and new players are simultaneously collaborating and competing. The banking service value chain is disrupted, and new players are staking new claims on profitable aspects they excel in performing. Business processes such as product marketing, considered to be the purview of banks, will be more effectively performed by TPPS as part of an ecosystem or marketplace

(2).

Service fulfillment and customer interaction processes need precise execution amongst ecosystem players in case anyone risk losing customers for latent transactions. Beyond the convenience that APIs (application programming interfaces) afford Open Banking, players need to orchestrate their technology stacks for collaboration – from data stores to transaction protocols to security. And, yes, agreements of various kinds will need to be put in place beginning with the access, sharing and use of customer data – while complying with any regional regulations.

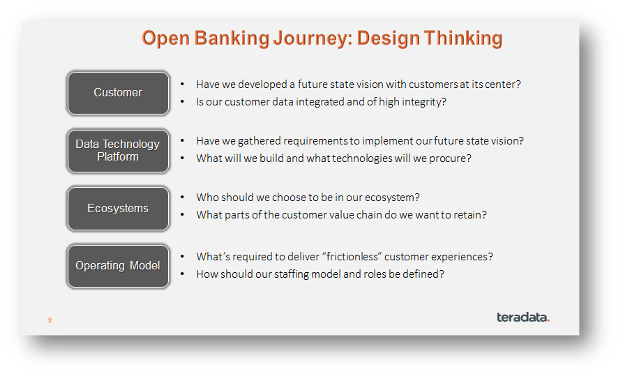

There’s a forked road just in front of banks today. The do-nothing path leads to obsolescence and loss of relevance. Banks shrink and perhaps expire. The do-something path leads to a journey of re-invention for banks – including the collaboration with medical providers, transportation agencies, manufacturers, and telco service providers to generate new sources of revenues and customers. No one can predict the outcome of Open Banking for any player or the path taken, but what has certainly risen to prominence is the central importance of customers, data technology platforms and ecosystems, pushing for big changes in operating models. And it’s in these four domains (depicted in the diagram below), where banks should invest now to remain pertinent in the new banking order.

Customers

Customers. Banks need to broaden how they think about customer financial needs. Customer needs range from daily micro-financing and payment mechanisms to longer-term strategic funding and asset management that cut across daily living and include concerns for the family and household. At its most basic level, banks should address a customer’s liquidity, cash flows, consumption and personal balance sheet in real-time.

Data Technology Platform. Insight and decisions about customers, operational efficiency, profitability and the overall business performance rely on data and analytics. It’s the foundation. Banks need to adopt a “data first” mindset and understand that investments in data yield multiples in terms of customer relationships and growth in lifetime portfolio value. To be prepared to lead a marketplace or participate in an ecosystem, a bank should think of equipping itself with no less than the tools sported by Big Tech

(3) today.

Ecosystems. Banks absolutely need to choose what primary partners they want to work with. Their continued shouldering of heavy regulation and guarding of customer data is deserving of the public’s “Trust.” They can “branch” out through partners to gain new customers and create or distribute new services via cross-industry partnerships.

Operating Model. Open Banking is not just “another channel.” It is a new way of doing business that requires the re-engineering of organizational design, business processes and financial models all aligned to a new set of strategic objectives

(4).

Real-time sharing of customer data and decisioning is re-defining banking. The plethora of innovations in services coupled with new entrants is projected to yield a net increase in the commercialization of financial services

(5). To remain central and relevant, banks must commit to implementing Open Banking initiatives that incorporate capabilities across four major pillars: Customers, Platforms, Risk & Security and Ecosystems.

Upcoming blogs explore what it means to adopt a customer-first strategy and the platforms required to support Open Banking, tackle risk and data security, and discuss the value proposition of ecosystems.

- Jack Ma’s Online Bank Is Leading a Quiet Revolution in Chinese Lending Big Tech, Fortune.com, July 29, 2019.

- Citi Builds Fintech Marketplace, Finextra, December 18, 2020.

- Apple Pay is on pace to account for 10% of all global card transactions, Quartz.com, February 11, 2020.

- Brazil's Bradesco spins off digital bank amid intensifying competition, S&P Global Market Intelligence, September 2, 2020.

- Open Banking Market Size to Reach $43.15 Billion by 2026, at 24.4% CAGR, GlobeNewswire, April 2020.

(Author):

Frank Saavedra-Lim

Frank is a financial services professional with extensive global experience as an executive and consultant serving the largest financial institutions in North America, Asia, Eastern Europe, South Africa, and Australia. He specializes in the design, planning, and implementation of risk operating models and supporting infrastructure inclusive of: data analytics and predictive modeling, process redesign, and risk applications development. Frank enjoys a track record as a risk technology innovator credited for conceptualizing and developing patented risk technology solutions for Fortune 100 firms. He has served as an executive panelist at the GARP annual risk management convention, was appointed Risk SME for PRMIA, and is the author of a 2018 Risk Management of the Future Study - a collaboration with the MIT Golub Center For Finance and Policy.

View all posts by Frank Saavedra-Lim