Data enables meeting customer expectations set by Big Tech

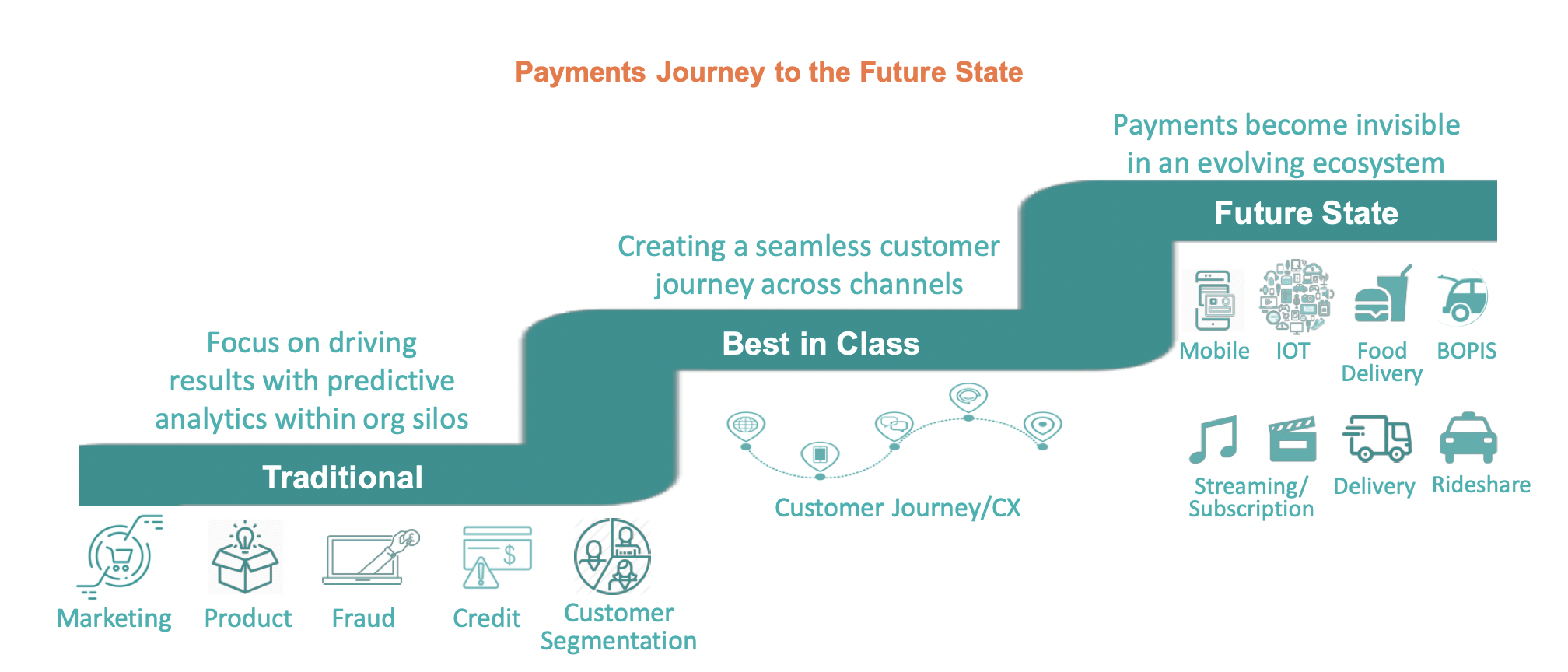

Customer expectations are increasingly set by Big Tech, and they anticipate seamless journeys across multiple channels – in-store, online, mobile, conversation commerce and more. The future of payments is rapidly evolving toward these seamless omni-channel customer journeys and ultimately, payments becoming invisible.

As we talked about in “Digital Payments Analytics Rapidly Respond to Changing Preferences and Emerging Value Propositions,

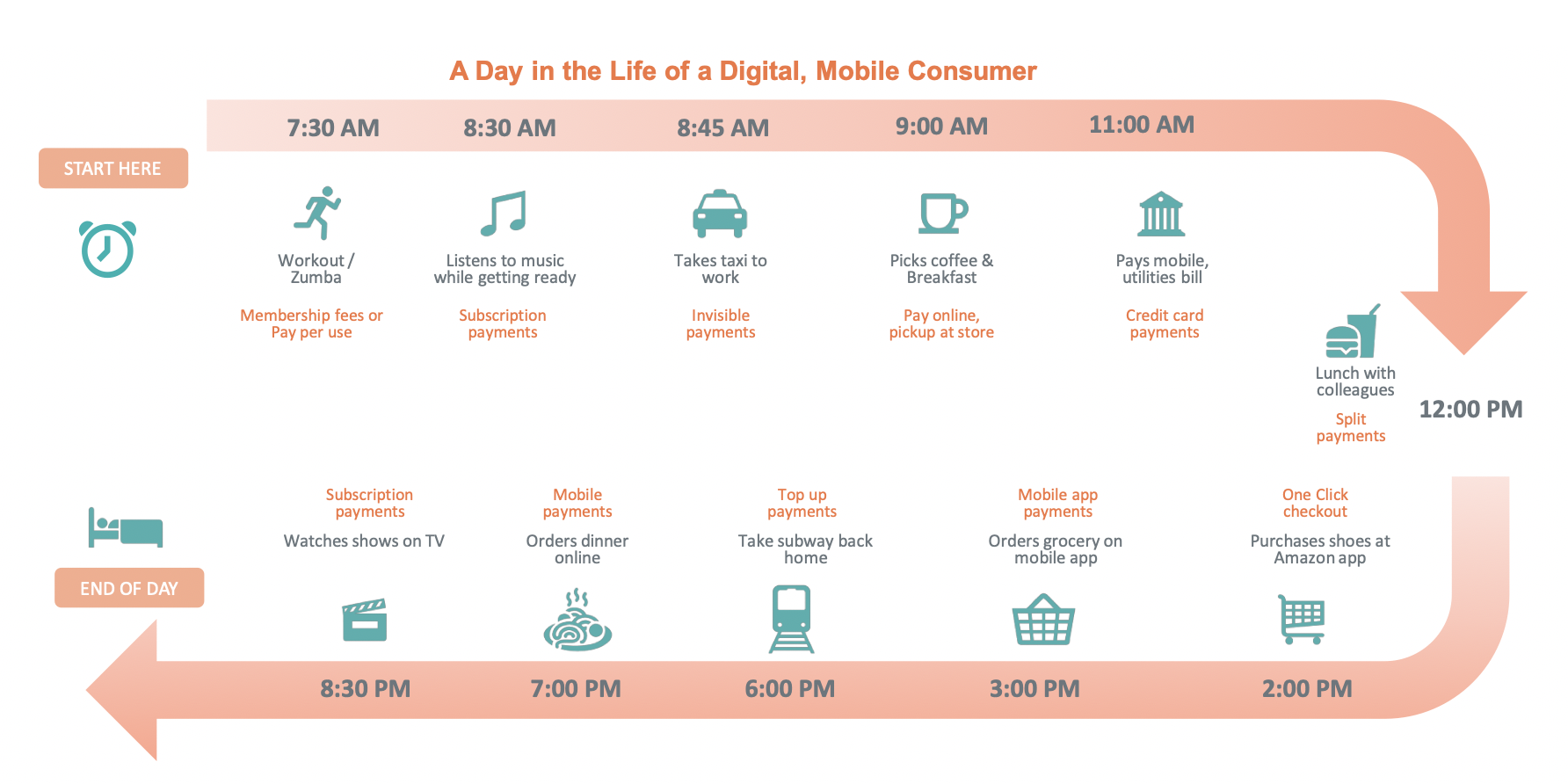

” payments are no longer something people do – they’re increasingly integrated into consumers’ everyday activities. In the day in the life of a digital mobile customer example below, there are more than ten payments made throughout the day, but only one – splitting the bill at lunch – involved an overt action. Subscriptions, invisible payments, card-on-file, wallets and automated top-up, all are done on behalf of a consumer, for convenience and without overt action.

This trend will accelerate. As consumers come to understand the attractiveness of new form factors, alternative payments, and better ways to authenticate themselves, they will start buying and paying for things through their voice assistants, wearables and cars. With the advent of open banking APIs, there will be more opportunities for instant and person-to-person payments. Continuous passive behavioral biometrics, using keystroke dynamics, gait analysis, voice identification, mouse use characteristics, signature analysis and cognitive biometrics, paired with geolocation and device characteristics, will authenticate users seamlessly and without the bother of using passwords. Finally, 5G-enabled IoT is rapidly connecting mobile devices, laptops, smart homes and wearables to enable machine-triggered payments.

In this future, payments players have a choice of strategies in integrating with the emerging smart financial ecosystem. There will be new alternatives, including instant payments, account transfers, authorized push payments and disbursements. Incumbent players, largely banks, can either partner with FinTechs or use branding and innovation to remain an oligopoly. Big Tech is already moving headlong into payments – PayPal, Amazon, Mercado Pago, PayU, Conekta, Facebook, WhatsApp and Apple, to name a few. Though Google, Samsung and Apple claim not to store or use transaction line-item detail,

many argue that Big Tech just wants to get into payments to harvest all the data.

Payments players that actively use payments data to position themselves into the emerging ecosystem will remain relevant and thrive. They will cater to changes in customer and small business behavior, develop new value propositions such as “Buy Now Pay Later” or small business receivables financing, and understand the attractiveness of new form factors, alternative payments and new forms of authentication. This will, in turn, improve recurring revenue, create new products and new lines of business, increase customer engagement and orchestrate a seamless customer experience.

See more at “

What Sort of Business Do You Want to Be?”

Deborah Baxley is an international mobile/cards payment consultant, recognized expert in the industry, creator of growth strategies for new and existing markets with more than 20 years’ experience consulting to cards and payment companies. She specializes in retail financial services, mobile payments, credit cards, technology strategy and business model development. Through her work in fifteen countries, she has advised issuers, acquirers, fintechs, networks and processors on product direction and competitive positioning, delivering millions of dollars in new revenue or operating cost savings.

View all posts by Deborah Baxley