Why Open Banking Platform Architecture Should be Driven by Efficiency

How should a CTO respond when their organization’s CEO publicly announces a commitment to delivering delightful customer experiences through Open Banking? For many, the answer will be slightly less than uninformed and non-strategic, and somewhat anchored by IT plans and architectures in-flight. Unfortunately, this decision is what separates winners from runners-up, simply due to failure in execution. The

last blog elaborated on what delightful customer experiences are. This one pivots to a technical tour that explores three foundational principles that should guide architectural design for Open Banking platforms: Interactions, Connectedness and Efficiency.

Banking is rapidly transitioning away from products and into a new era of serving people’s lifestyles powered by customized financial services. A “monetary nervous system” comprised of connected services and analytics needs to be supported by robust architectures enabling frictionless customer experiences. There are massive volumes of banking data, high-speed concurrent access, and analytic model execution across numerous ecosystem partners. Like today’s advanced automobiles, Open Banking platforms require high-reliability and seamless interfaces. More powerful and intelligent engines have adaptive features that will evolve with Open Banking.

Interactions – Sustained linkage with Customers. The basis for Open Banking is increased fluidity in interactions amongst ecosystem partners and customers through multiple channels while supported by API-based transmissions of data through services. Platform designs inspired by the efficient execution of customer interactions enjoy longer periods of relevance and value to banking organizations and customers alike. Interaction-centric designs are naturally predicated on what comes next in developing a platform, especially when “you get into and interact on the Cloud.”

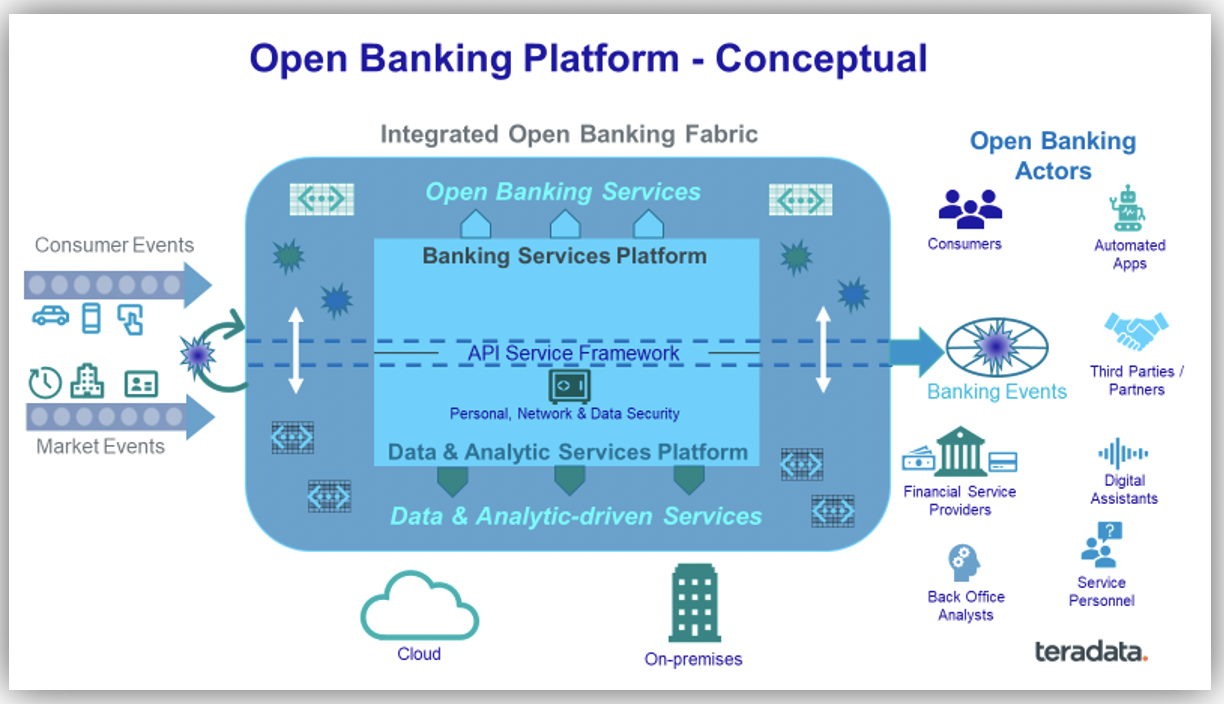

Consumers want to transact in whatever mode and whenever they desire. The illustration below highlights the delivery of services consumers need, when they need them in forms that are easy to use regardless of delivery channel service provider. An Open Banking “Fabric” is activated when consumer events trigger responses to consumer needs through flexible service delivery. These services in turn, leverage consumer and market-related events influencing activity within the fabric. The activity results in the delivery of integrated experiences back to the consumer and other ‘actors’ that either use or provide the banking services.

The core fabric components are the Open Banking Services and the Data & Analytics Services platforms. These provide analytic-enabled processing, working together through an API framework to facilitate secure service communication and synchronization across the fabric. The APIs effectively facilitate delivery of these services and events that are weaved together through the fabric for seamless use across the Open Banking environment.

Connectedness – Integrated Open Banking Fabric.

Connectedness – Integrated Open Banking Fabric. The banking services platform creates and executes flexible Open Banking capabilities developed by third parties. These capabilities depend on information and analytic intelligence driven by the data and analytic services platform, which provides the analytic engines that target intelligent data and analytics specifically at the needs and desires of the consumer. Interactions with the consumer through banking events are generated and tracked across the fabric to meet the consumer’s needs and to analyze and refine the services to improve customer service levels and increase the overall Open Banking effectiveness. These events are streamed into the fabric along with external events and captured in the data stores for use by the platforms.

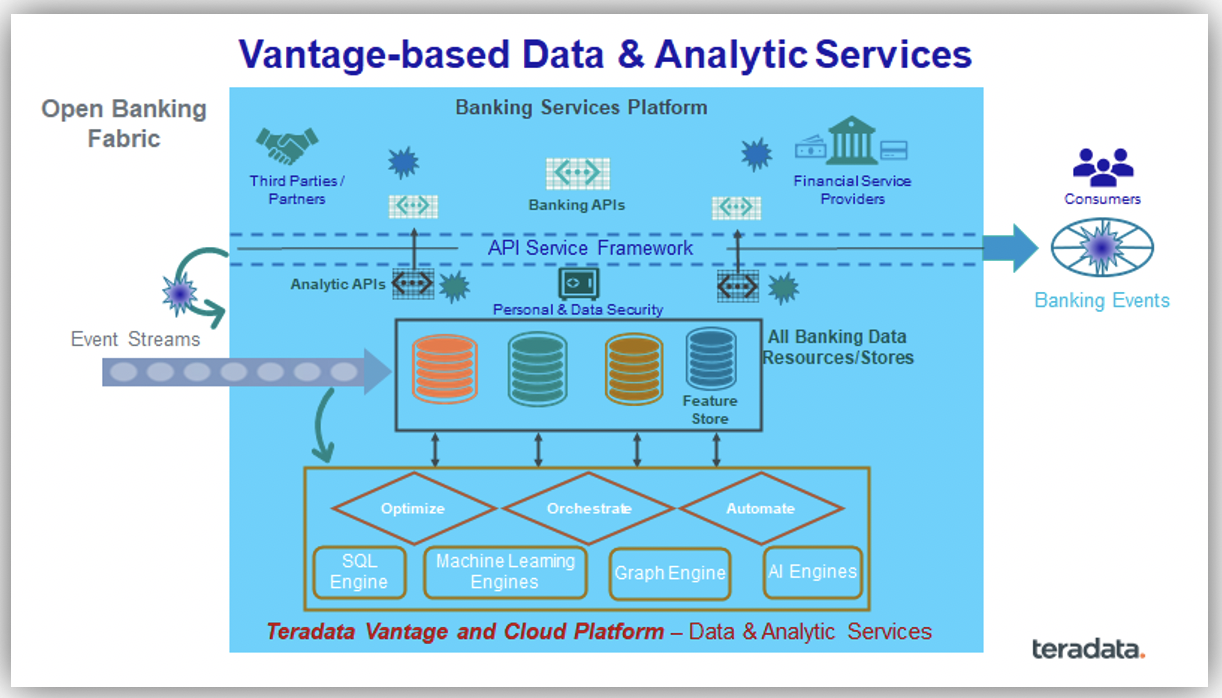

Supplying the advanced orchestration and connectedness to the data and analytic services platform is

Teradata Vantage. Vantage enables all actors to securely leverage highly scalable data and analytic processing across the fabric. Powering Vantage are sets of highly functional, purpose-built engines that deliver the analytic intelligence to the Open Banking Services. These Vantage and integrated third-party engines enable flexible, reliable, and high-performance analytic processing leveraging all data resources available across the environment.

Efficiency. On the Cloud and Beyond.

Efficiency. On the Cloud and Beyond. It’s not enough to have an instance of a platform or to enable it on the Cloud. All new platform designs as well as incremental platform developments must recognize efficiency requirements. What would be the implications of latent customer experiences? How will a bank optimize cyclical demands on data access and execution of transaction decisioning models? How does an organization optimize their platform in the Cloud? It’s simply too expensive a proposition to wait until an organization’s demand for scale, speed, and flexibility is exceeded and the only way to continue to service customers is to inefficiently scale the platform, which adds a drag coefficient to margins. Throwing hardware at scaling issues that are better solved by intelligent software is the root of many run-away cost challenges – even in the Cloud. Teradata Vantage is proven to be the most efficient in the financial industry at supporting extreme scale data and analytic processing needs. Underlying platform efficiency provides financial resiliency that is critical for an organization to be successful as Open Banking solutions scale to meet the needs of customers and service providers alike.

Open Banking mandates that organizations adopt foundational principles for selecting and implementing platform technologies. The development of creative services is accelerating, with Cloud-enabled, service-led fungible platforms at the heart of successful operations and business models. The winners think ‘beyond the box’ and go long on their commitments to Open Banking. They challenge convention by asking hard questions like: what will be the advanced data and analytics foundation? or, how will the bank orchestrate all service flows efficiently? The future of Open Banking is about intelligent automation and workflow execution enabling financial services for a “segment of 1.” And importantly, the platforms that power these services need to address these questions and more as Open Banking becomes a reality.

In the next discussion, we will look at the risks that need to be acknowledged and managed as Open Banking unfolds.

As a Senior Director & Principal Architect within Teradata, Bob supports a wide range of disciplines ranging from business consulting to in-depth technical services across many industries and business domains. He applies his 37+ years of experience and 25+ Teradata years with architecture and large-scale data & analytic implementations to help customers realize the full potential of their data and analytic investments. Bob focuses most of his current efforts on modern Data and Ecosystem architecture best practices.

View all posts by Bob Fintel

(Author):

Frank Saavedra-Lim

Frank is a financial services professional with extensive global experience as an executive and consultant serving the largest financial institutions in North America, Asia, Eastern Europe, South Africa, and Australia. He specializes in the design, planning, and implementation of risk operating models and supporting infrastructure inclusive of: data analytics and predictive modeling, process redesign, and risk applications development. Frank enjoys a track record as a risk technology innovator credited for conceptualizing and developing patented risk technology solutions for Fortune 100 firms. He has served as an executive panelist at the GARP annual risk management convention, was appointed Risk SME for PRMIA, and is the author of a 2018 Risk Management of the Future Study - a collaboration with the MIT Golub Center For Finance and Policy.

View all posts by Frank Saavedra-Lim